ترجمه پیشنهادی "برگ مالیات قطعی" به شرح زیر ارائه می گردد:

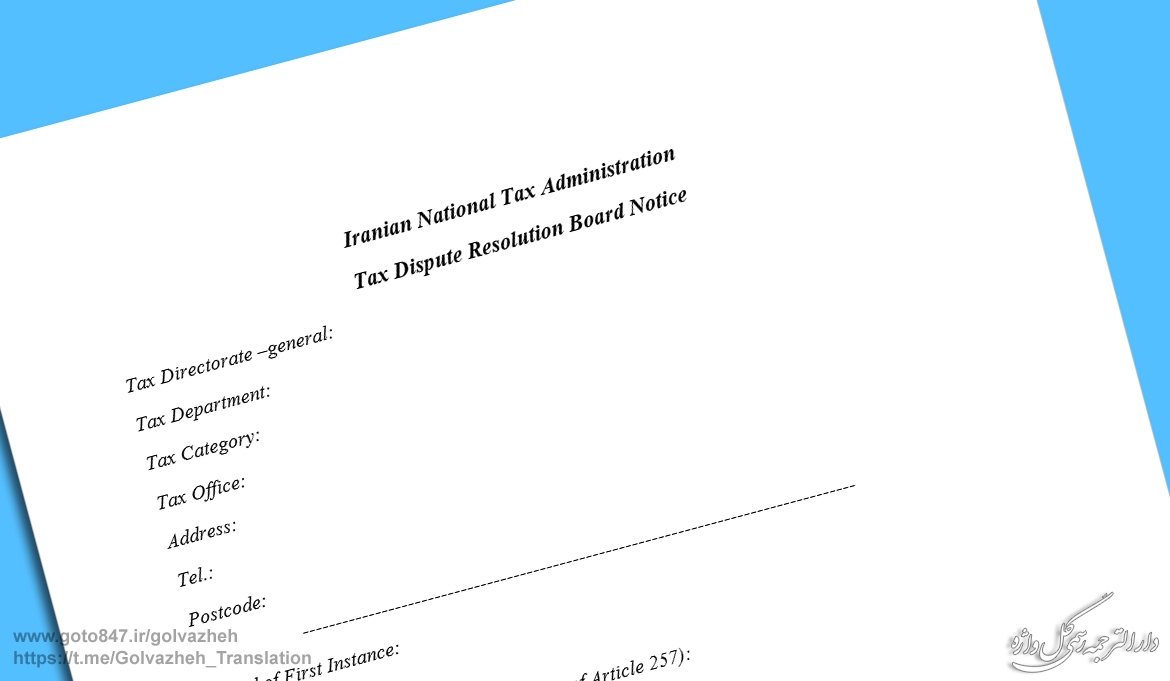

Iranian National Tax Administration

Tax Dispute Resolution Board Notice

Tax Directorate –general:

Tax Department:

Tax Category:

Tax Office:

Address:

Tel.:

Postcode:

------------------------------------------------------------------------------------

Board of First Instance:

Board of Appeal:

Board of Concurrent Jurisdiction (Subject of Article 257):

Other

Number:

Date:

File Number:

------------------------------------------------------------------------------------

Natural Person’s Particulars:

Name:

Surname:

Type of Activity:

Father’s Name:

ID Card / Birth Certificate Number:

Place of Issue of ID Card / Birth Certificate:

National ID Number:

Economic Code:

Postcode:

Address:

----------------------------------------------------------------------------------------------

Legal Entity’s Particulars:

Name:

Type of Activity:

Type of Legal Entity:

Registration Number:

Registration Date:

Place of Registration:

Economic Code:

Address:

Tel.:

Postcode:

Tax Payer’s Representative as per the tax appeal:

Tax Payer has not introduced their representative:

--------------------------------------------------------------------------------------------

As your tax file related to tax year / period ….. shall be heard in the Tax Dispute Resolution board at … , on: ……. , you are requested to attend at: ….. providing all the documents related to the abovementioned tax year / period. It is crystal clear that as per the provisions of Note of Article 246 of the Direct Tax Law, failure of the tax payer or their representative and the representative of the respective Tax Department to attend the hearing, shall not prevent the consideration of the file and issuance of the verdict.

---------------------------------------------------------------------------------------------

For tax Officer:

Full name:

Position:

[Signed and Stamped]

------------------------------------------------------------------------------------------------

For the Taxpayer:

I, ……. received this notice, on …..

I, ……, as the taxpayer’s …..received this notice on …… and undertake to serve it on the taxpayer; [signed]

---------------------------------------------------------------------------------------------

For Service Officer:

I, ……, served this notice on the taxpayer at his/her residence / work place with the address mentioned in this notice on ….; , and certify the authenticity of the taxpayer’s signature; [signed]

Because the taxpayer / his/ her relatives or employees was / were not available / refused to receive the notice on ……. I, installed the notice on his/her residence / work place door at the address mentioned in this notice; [signed]

---------------------------------------------------------------------------------------------

For Postman:

I, ……,

- Served this notice on the taxpayer at his/her residence / work place with the address mentioned in this notice on …. , and certify the authenticity of the taxpayer’s signature; [signed]

- As the tax payer or his/her relatives and employees were not available, I posted this notice on his residence / work place door, with the address mentioned in this notice, and I will return after fifteen days on: …… [signed]

- As the tax payer or his/her relatives and employees were not available for a second time, I posted this notice on his residence / work place door, with the address mentioned in this notice on: …… [signed]

مدیر مسئول: سعید علیمیرزایی

- مشاوره در امور ترجمه رسمی و غیررسمی

- ترجمه رسمی کلیه اسناد و مدارک به زبانهای مختلف

- ترجمه رسمی و غیررسمی قراردادها و گزارشات مالی شرکتها

- ترجمه کتب و مقالات علمی

- ترجمه شفاهی (حضوری) در محضرها و دفاتر اسناد رسمی

- اعزام مترجم شفاهی به سمینارها و جلسات تجاری

- انجام مکاتبات تجاری (دریافت و تحویل کار از طریق فکس یا ایـمیل به صورت رایگان)

- صحبت با طرفهای تجاری شما از طریق تلفن

- مشاوره در امور ترجمه رسمی و غیررسمی (رایگان)

- صدور معرفینامه برای مشتریان جهت مراجعه به مراکز دریافت گواهی عدم سوء پیشینه (رایگان)

- تکمیل و تایپ فرمهای سفارت، فرم درخواست کارت بازرگانی، و غیره

آدرس: میدان فاطمی، خیابان شهید طباطبایی (چنب مسجد نور)، پلاک 12، طبقه پنجم

نظر خود را اضافه کنید.

ارسال نظر به عنوان مهمان